rav4 prime tax credit massachusetts

The premium model denoted as the RAV4 Prime XSE will begin at 41425 and be reduced to 35045 after applying the federal tax credit. Doug DeMuro May 4 2021.

2022 Toyota Rav4 Hybrid Limited Littleton Ma Near Acton Concord Westford Massachusetts 4t3d6rfv7nu082495

Starting on January 1 2020 MOR-EV will be extended to support qualifying battery electric vehicles BEVs and fuel cell electric vehicles FCEVs up to a 50000 final purchase price.

. A loaded NX 450h is less than 10k more. Secondly I dont agree that after 812 if this is signed on that date the tax credit will become 0 for RAV4 Prime. The 2022 Toyota RAV4 Prime starts at.

2022 Toyota RAV4 Prime. In the next few weeks the United States government will stop giving a 7500. 2021 RAV4 Prime MA Savings Buy A Toyota.

We ended up buying at 3k over to secure the tax credit. As long as the final sales price is under 50000. Big Chunk of Owners Will Not Buy 2022 Toyota RAV4 Prime Because of Tax Credit Phaseout.

It will remain 7500 until end of September Q3 then 3750 until end of. If you have been searching for a 2022 RAV4 Prime in the past few months you may recognize state names like Massachusetts New. Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up To 7500.

RAV4 Primes battery can be fully charged in about 12 hours by plugging the included charging cable into a standard household outlet. Prime is final assembled in Japan. The information listed below contains current rebate information for vehicles purchased after January 1 2020.

120V 12A When using a public charging station. The number of Toyota EV sales makes buying a RAV4 Prime a more time-sensitive issue for those who want the tax credit. The 2021 Toyota RAV4 Prime qualifies for the full 7500 tax credit because of its larger battery Kelley Blue Book reports.

New criteria for the MOR-EV program starting on January 1. At the time of publication the RAV4 Prime XSE and SE are both still eligible according to the United States Department of Energy. The 2022 Toyota RAV4 Prime True Cost to Own includes depreciation taxes financing fuel costs insurance maintenance repairs and tax credits over the span of 5 years of ownership.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a. The Federal Tax Credit is gone for the Prime due to the new requirement that the vehicle final assembly occurs in North America. If you want MSRP waitlists are much shorter than the Rav4 Prime 6 months.

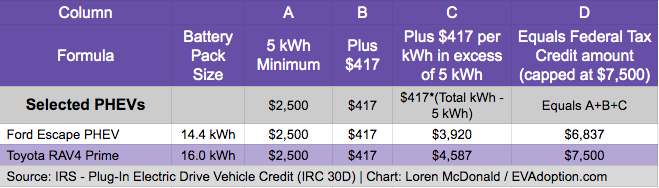

The credit is calculated using a rate of 417 per kWh.

Toyota Reaches Ev Tax Credit Cap Cnet

Will The Toyota Rav4 Prime Phev Become The New Prius Evadoption

The Next Phase Of The Mor Ev Rebate Program Sierra Club

Used 2012 Toyota Rav4 Limited V6 For Sale With Photos Cargurus

2022 Electric Vehicle Ev Charging Rebates Incentives

Certified Pre Owned 2021 Honda Pilot Ex L Awd Sport Utility In Ph95651 Nucar Massachusetts

New Toyota Rav4 Hybrid For Sale In Danvers Ma

State Electric Vehicle Tax Credits Electric Hybrid Alternative For 2022

Ev Tax Credit Consequence Plug In Vehicle Lease Prices Are Soaring

Is The Toyota Rav4 Prime Eligible For The Tax Rebate

Certified Pre Owned 2022 Honda Pilot Special Edition Awd Sport Utility In Ph95717 Nucar Massachusetts

Nys Electric Vehicle Rebate At Hoselton Auto Mall In East Rochester Ny New Pre Owned And Certified Vehicles

Kia Electric Vehicle Tax Credits Ma Electric Car Incentives

Toyota Runs Out Of Ev Tax Credits As First Mainstream Ev Hits Dealers

Ev Tax Credit Boost At Up To 12 500 Here S How The Two Versions Compare

Ev Tax Credit Consequence Plug In Vehicle Lease Prices Are Soaring

Updated 2017 Incentives For Electric Vehicles And Evse For Tesla And More

Federal Tax Credits Will Soon Be Phased Out For Toyota Ev Customers In The Us Electrek